Value Locked in Defi Continues to Slide, ETH Defi Dominates by 65%, Solana Transactions Reign – Defi Bitcoin News

The total value locked (TVL) in decentralized finance has slid 15.63% since the metric’s all-time high of $275 billion sixteen days ago on December 1. Since the end of the first week of December, the TVL is down 7.19% lower with a number of protocols seeing seven-day losses in terms of TVL.

Defi Tokens YFI and CVX See 7-Day Double-Digit Gains, Aggregate Locked in Defi Slips Close to 3% to $243 Billion

According to statistics, decentralized finance (defi) tokens represent $132.6 billion or roughly 5.79% of the entire $2.28 trillion crypto economy. The largest defi token in terms of market capitalization is terra (LUNA), which commands 18% dominance and a market valuation of around $23.9 billion. The top two performing defi assets during the last week were yearn finance (YFI) and convex finance (CVX). Yearn finance jumped 33% in value this past week and convex finance increased in value by 26.3%.

Meanwhile, the defi tokens tokemak (TOKE) and bonfida (FIDA) saw the deepest weekly losses last week. Tokemak lost 31.6% in value last week and bonfida shed 28.7% in USD value. The top decentralized exchange (dex) on Friday is Uniswap version 3 with $2 billion in 24-hour volume. Uniswap (v3) is followed by Pancakeswap, Trader Joe, Biswap, Sushiswap, Uniswap (v2), Raydium2, and Curve Finance, respectively.

There’s been $6.2 billion in 24-hour dex trade volume and 158,035,713 monthly visits to dex protocols. According to defillama.com, the aggregate total value locked (TVL) across a myriad of blockchains is $232 billion with Curve dominance at 9.17%. Curve’s TVL is $21.28 billion and it supports seven different blockchains.

Ethereum Still Dominates the Defi Landscape, Solana Transactions at 45 Billion, Cross-Chain Bridge TVL Slides 3.4% Last Month

Out of all the recorded defi blockchains, Ethereum commands $159.64 billion TVL in defi today which equates to 65.44% of the aggregated defi TVL. Binance smart chain (BSC) is the second-largest blockchain in terms of TVL in defi today. BSC has a $16.53 billion TVL on Friday which is roughly 6.77% of the $243.94 billion locked in defi. The chains that follow BSC include Terra, Solana, Avalanche, Tron, Polygon, and Fantom, respectively. Out of all the chains this past week, the only top-ten defi chains that gained a higher TVL percentage were Fantom (3.52%) and BSC (1.75%).

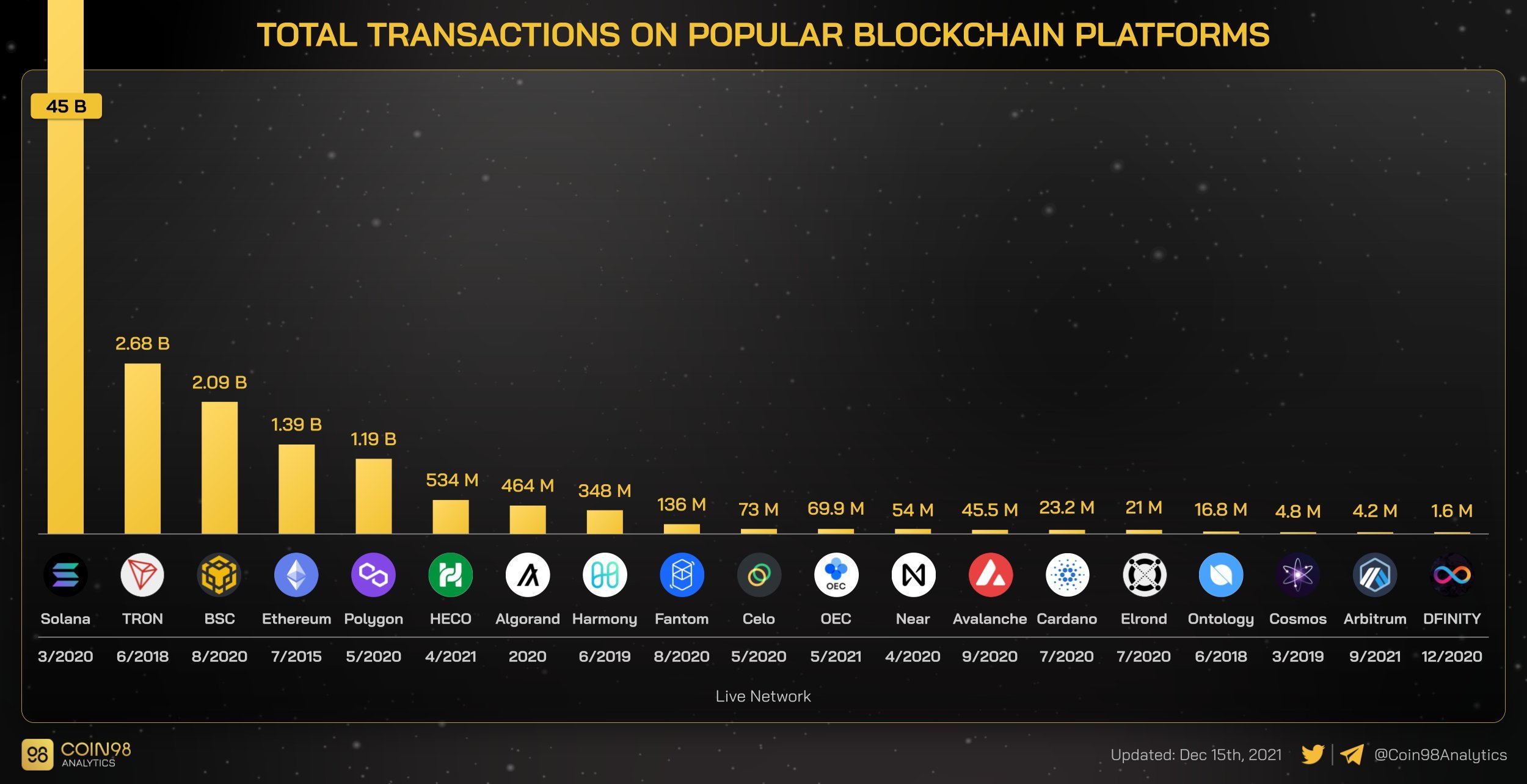

Statistics from Coin98 Analytics indicate that in terms of the total transactions for blockchain networks Solana holds the reins with 45 billion. Solana’s transaction dominance is followed by Tron (2.68B), BSC (2.09B), Ethereum (1.39B), Polygon (1.19B), HECO (534M), and Algorand (464M). As far as the number of validators on popular blockchains, Coin98 Analytics metrics show Ethereum has 270,322 validators, while Elrond has 3,222.

Lastly, as far as the TVL in cross-chain bridges is concerned, there’s $22.73 billion in cross-chain bridge TVL today. There’s been a 3.4% loss in TVL during the last 30 days and Ronin Bridge commands the top position with $6.4 billion. Ronin is followed by Avalanche ($5.88B), Polygon ($5.83B), Arbitrum ($2.3B), Fantom ($1.3B), and Optimism ($433M).

What do you think about the state of decentralized finance (defi), decentralized exchange (dex) applications, and the total value locked in these blockchains? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.