Bitcoin Price Prediction as Halving Event in 2024 Sparks Bullish Sentiments – Time to Buy?

The BTC/USD is currently witnessing a decline of nearly 0.50%, with its value standing at $29,400.

As the cryptocurrency market navigates this shift, Bitcoin faces intensified price pressure in anticipation of the Bitcoin halving event in 2024 and a crucial decision by the US Securities and Exchange Commission (SEC) regarding an ETF application.

Moreover, releasing US inflation data adds an additional layer of uncertainty to the market’s trajectory.

In this context, we delve into the factors shaping Bitcoin’s current dynamics and its potential outlook.

Bitcoin Halving Event 2024

Scheduled for April 26, 2024, the upcoming Bitcoin halving event is poised to reduce the block reward to 3.125 BTC, a date calculated based on current estimations.

This halving underscores a pivotal aspect of Bitcoin’s monetary strategy, aiming to manage inflation rates and enhance scarcity, thus driving long-term value.

As each halving event decreases the new Bitcoins produced per block, the cryptocurrency’s supply tightens, echoing the deflationary concept of assets like gold.

This diminishing supply and rising demand historically result in potential price appreciation.

Ultimately, Bitcoin’s halving reinforces its distinct position, capping its total supply at 21 million coins, in contrast to traditional fiat currencies prone to inflation.

This event’s historical trend of spurring price growth further underscores the intricate relationship between scarcity, demand, and Bitcoin’s value, making the impending halving’s impact on price a keenly anticipated aspect of the cryptocurrency’s ongoing narrative.

BTC Price Pressure Heightens Ahead of Crucial SEC ETF Decision

The SEC is expected to announce a decision on the ARK 21Shares Bitcoin ETF tomorrow, a day ahead of the official Aug. 13 deadline.

This announcement is highly anticipated in the crypto market, but a delay is possible.

It could pressure BTC prices, as the announcement will likely occur after the market closes.

Prominent financial firms, including BlackRock, Bitwise, Van Eck, and Wisdomtree, are seeking regulatory approval for their Bitcoin ETFs.

ARK 21Shares holds a time advantage, potentially leading the ETF race. However, concerns over market manipulation, liquidity, and investor protection could hinder or stall these ETFs.

The upcoming days are crucial for ARK 21Shares and its competitors as they navigate the path to approval amidst ongoing challenges.

US Inflation Data Fuels Uncertainty

The US Bureau of Labor Statistics reported a 3.2% inflation increase in July, slightly lower than the market’s 3.3% expectation.

The uncertainty in BTC price movement is due to the Federal Reserve’s potential sustained hawkish stance because of the lower-than-expected CPI data.

The impact of inflation on Bitcoin’s price is uncertain, as reflected by BTC’s current value below $30,000 after the July data release.

This is despite the success of the widely-used inflation measure, CPI, in highlighting the Federal Reserve’s liquidity reduction.

Historically, Bitcoin has surged due to inflation, with the Fed’s 2021 monetary expansion driving it to a record high of $65,000.

However, the current CPI report has not caused a bullish rally, and bulls are waiting for a catalyst to move past the $30K resistance level.

Bitcoin Price Prediction

Bitcoin is presently being traded at approximately $29,400 and appears to be neutral as it is facing some difficulties in surpassing the $29,600 mark, as indicated by the four-hour timeframe.

On the upside, a bullish breakout above the $29,600 level can potentially expose the BTC price toward the $30,200 level.

Bitcoin has reached the 61.8% Fibonacci retracement level at $29,200. The closing of doji candles above this level suggests a potential bullish correction.

If it drops below, BTC may descend toward $29,250.

On the other hand, overcoming the $30,200 resistance might push BTC toward the range of $30,600 to $31,000.

The zones at $29,800 and $30,200 are critical. Potential shifts below them indicate a bearish trajectory for BTC.C.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

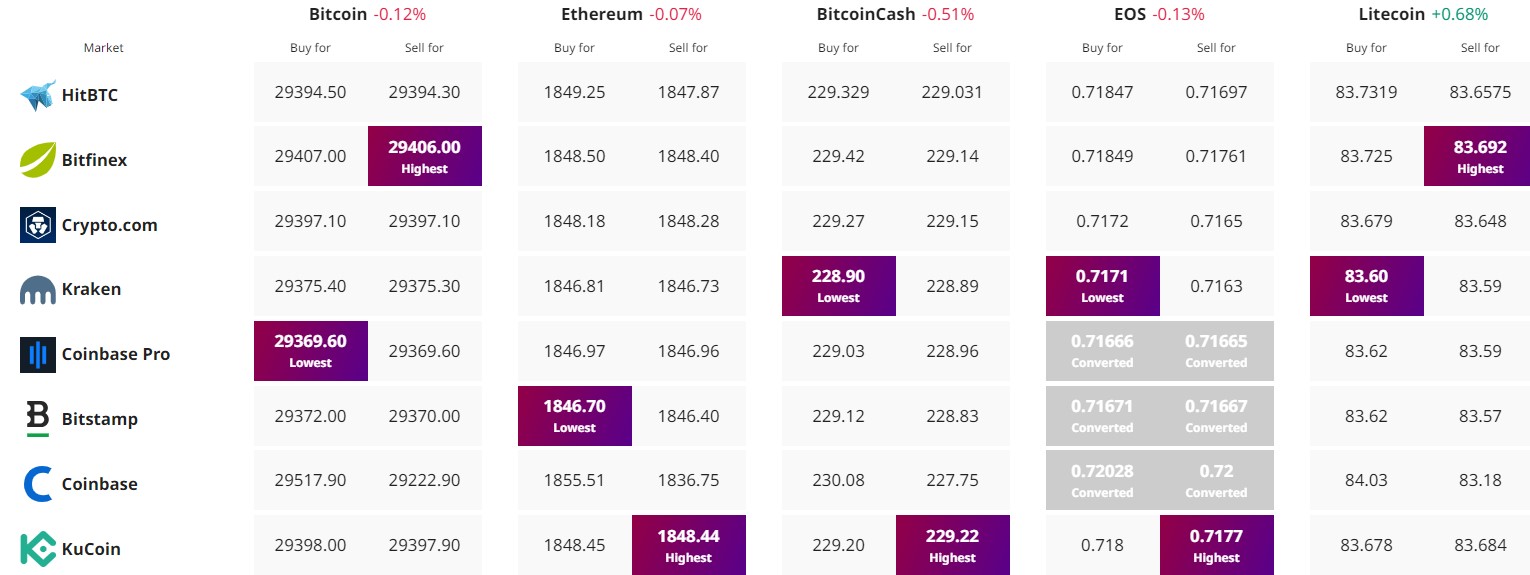

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.